This section will show the TDS deducted from your salary / pension income and also TDS deducted by banks on your interest income. PART A- Details of Tax Deducted at Source (All amount values are in INR) The Form 26AS (Annual Tax Statement) for an Assessment Year is divided into parts described below The password for opening Form 26AS will be your Date of Birth (in DDMMYYYY format), e.g., if your date of birth is 0, password will be 03021981.

It is a live document which is updated as the transactions are reported / processed for the given FY. Form 26AS will be generated whenever tax related transaction(TDS deducted,Advance tax paid) happens in relation to the tax payer.Form 26AS, what exactly to verify in Form 26AS with the Form 16, Form 16A issued and Advance Tax, Self Assessment Tax paid. The same should be verified before claiming tax credit and only the amount which pertains to you should be claimed. Tax Credits appearing in Part A, A1 and B of the Annual Tax Statement are on the basis of details given by deductor in the TDS or TCS statement filed by them.

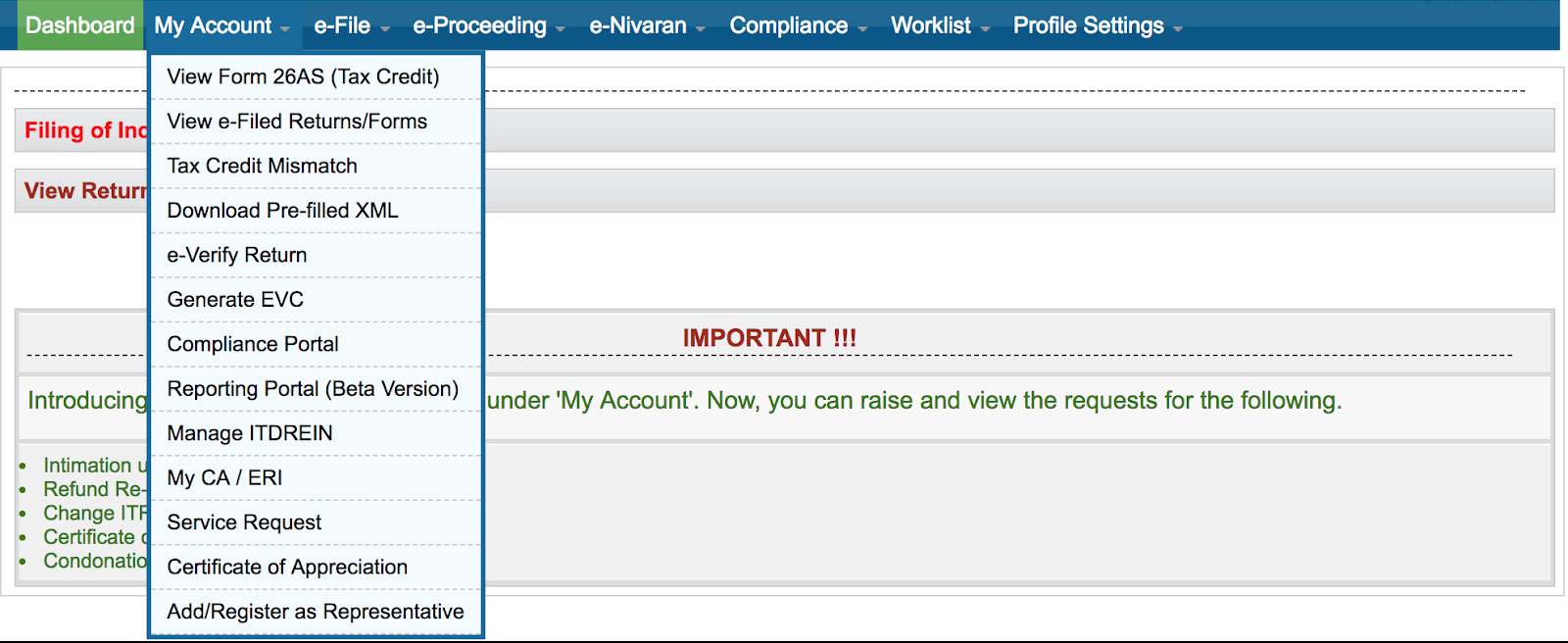

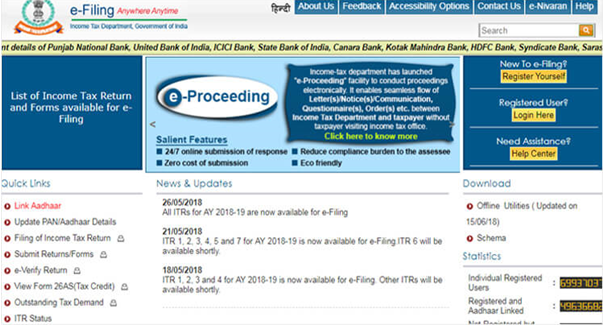

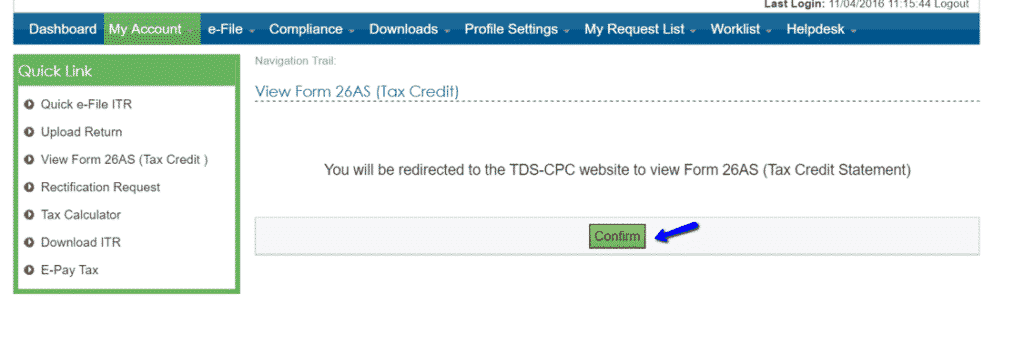

The due date for filing income tax return is nearing which is 31 st July so you need to know about the various important documents required in details for filing your income tax returns.Ĭhecklist of documents required for E-filing income tax return: Documents required Importance of Form 26AS This article explains Form 26AS in detail with images. This form contains the annual tax statement under Section 203AA and Rule 31AB. It shows how much of your tax has been received by the government and is consolidated from multiple sources like your salary / pension / interest income etc. You should check it before filing your tax return which will help you in eliminating any errors in tax calculation to file an accurate return.Īvoid last minute mistake while filing income tax returns: Tax filing mistakesįorm 26AS also called Annual Statement, is a consolidated tax statement which has all tax related information (TDS, TCS, Refund etc) associated with a PAN. Form 26AS or tax credit statement gives you all the important details of taxes you have paid.

0 kommentar(er)

0 kommentar(er)